Give up Smoking: How Tobacco Impacts Your Finances

The health hazards of smoking have been spoken about by people most of the time, but the financial damage is the unnoticed aspect that requires more attention. The financial implications of tobacco use are often underestimated, and this article delves into how smoking impacts your economic status. We will explore the significant savings that may be attained by quitting this costly habit and ensure insights into keeping a smoke-free way of life on track. Then, you can decide whether you want to keep 'quit smoking and save money' as your life mantra

The Financial Impact of Using Tobacco

One of the most captivating reasons to stop smoking is the economic implications. Tobacco use has far-reaching effects on your pockets beyond just the cost of cigarettes. It consists of high medical insurance charges, massive medical payments, and decreased productivity because of health-related problems. Understanding the monetary pressure smoking imposes may be a powerful motivator for quitting. People will start with one cigarette, and eventually, one cigarette becomes insignificant. Unknowingly, the numbers go high, along with a financial burden. This pattern of smoking increases the daily expense of the smoker.

How Much Money Do Tobacco Users Spend?

Tobacco users often underestimate the entire expenses related to their habit. The price of cigarettes is considered the tip of the iceberg. When you calculate the monthly smoking expenses, the numbers may be overwhelming. A pack-a-day smoker probably spends hundreds of dollars monthly on cigarettes, which adds to thousands yearly.

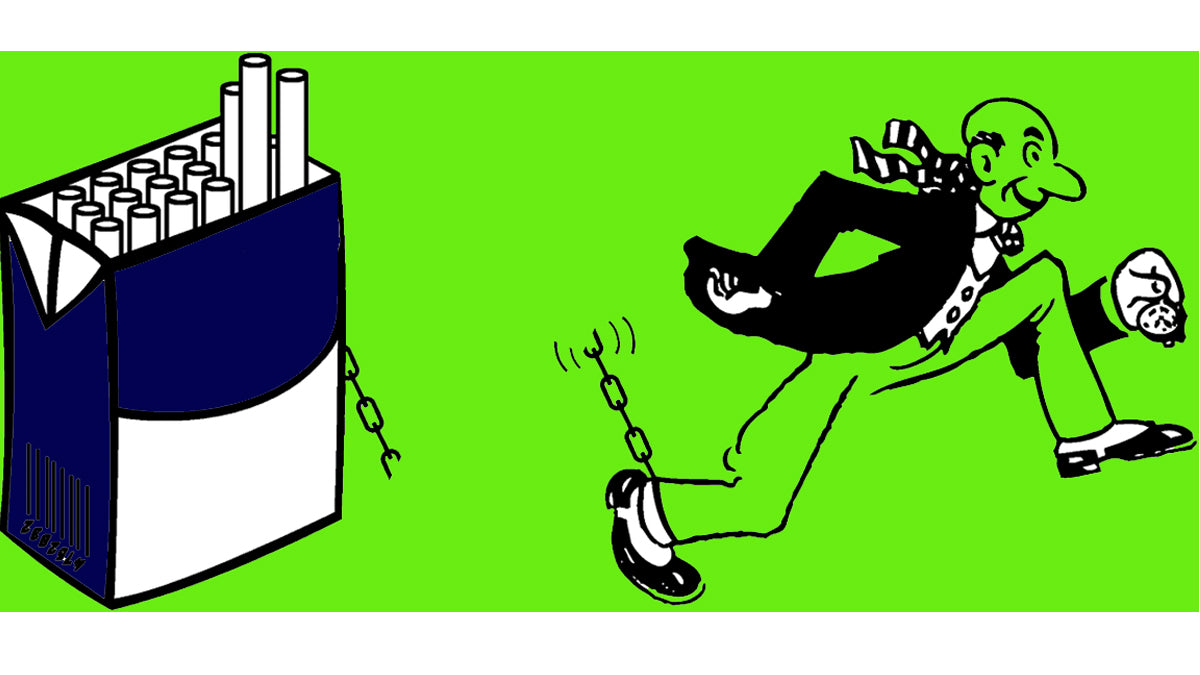

The Impact of Quitting Tobacco on Finances

Quitting Tobacco is not just an investment in your health; it's also a favourable financial decision. The immediate savings from not purchasing cigarettes accumulate rapidly. Moreover, ex-smokers often benefit from diminished health insurance premiums and more occasional medical expenses in the long run. Quitting tobacco is a potent financial decision that entirely impacts your financial health.

Here are some key ways in which quitting smoking leads to financial benefits:

- Immediate Savings: The most evident financial benefit is the immediate savings from not buying cigarettes. This can quickly accumulate into substantial amounts of money that can be better allocated.

- Reduced Health Expenses: Ex-smokers generally experience fewer health problems. As a result, medical bills decrease, leading to significant long-term financial benefits.

- Lower Insurance Premiums: Health and life insurance premiums are typically lower for non-smokers. This results in annual savings and contributes to improved financial security.

- Increased Productivity: As health improves and energy levels rise, ex-smokers often experience an increase in productivity at work. It accelerates career growth and potentially higher income.

- Quality of Life: A smoke-free lifestyle permits individuals to relish a higher quality of life. Redirecting money previously spent on tobacco towards activities that promote well-being and happiness is a priceless financial investment.

The Long-Term Financial Outlook

The long-term financial advantages of quitting tobacco are substantial. The immediate savings from not purchasing cigarettes can be redirected towards various financial goals, such as:

- Savings and Investments: Allocate the money saved by quitting smoking towards building an emergency fund or investing in stocks, bonds, or retirement accounts. This enhances your financial security and long-term wealth.

- Debt Reduction: Use your newfound savings to pay off high-interest debts or mortgages. Reducing debt not only saves money on interest payments but also improves your credit score.

- Education and Skills Enhancement: Consider investing in your education or acquiring new skills. These investments can lead to career advancements, potentially increasing your income over time.

- Wellness and Self-Care: Give prominence to your health and follow Healthy Habits To Replace Smoking and Promote Well-being using your financial savings to fund fitness memberships, wellness retreats, or mindfulness practices.

How Much Money Can You Save If You Curb Smoking?

The financial advantages of Quitting Smoking are substantial. On average, a pack-a-day smoker can save thousands of dollars annually by choosing to quit. These savings can be redirected towards more beneficial pursuits. Let's explore how you can maximise these savings and secure your financial future.

How Do You Keep a Smoke-Free Lifestyle on Track?

- Allocate Your Savings: Calculate the money you save by not buying cigarettes and allocate it towards specific goals. Whether it's building an emergency fund, investing, or taking a dream vacation, having a purpose for your savings can be highly motivating.

- Seek Support: You don't have to go through the journey alone. Join smoking cessation groups, seek support from friends and family, or consult healthcare professionals. Having a support system can make the transition to a smoke-free life more manageable.

- Reward Yourself: Acknowledge your achievements along the way. Set milestones and treat yourself to something special as a way of celebrating your progress. These rewards can serve as positive reinforcement.

- Focus on Health and Wellness: Redirect the money and energy previously spent on smoking toward activities that promote physical and mental well-being. Consider joining a gym, taking up a new hobby, or exploring mindfulness practices. Prioritising your health can be the best investment.

- Track Your Progress: Keeping a record of your smoke-free milestones can be a powerful motivator. Visualising your success in terms of time and money saved can strengthen your commitment to a smoke-free life.

- Establish a Smoke-Free Environment: Eliminate reminders of smoking in your daily life. Dispose of ashtrays, lighters, and any paraphernalia associated with smoking.

Conclusion

The economic impact of smoking extends well beyond the price of a pack of cigarettes. It encompasses higher health expenses, better coverage premiums, and decreased productiveness due to fitness troubles. The financial consequences of tobacco use may be considerable. However, the answer is clear: give up smoking. By moving smoke-free, you no longer invest in a bright future but also steady a more optimistic economic outlook. The money saved can be redirected toward endeavours that enrich your life, paving the way for a more fulfilling and prosperous future. Your health and your wallet will undoubtedly thank you. It's time to take the first step toward a smoke-free and financially secure tomorrow.

FAQs

1.How much money can I save by quitting smoking?

You can save thousands annually by quitting smoking, depending on your smoking habits.

2. What are the financial benefits of quitting smoking?

Financial benefits include savings on cigarettes, reduced healthcare costs, and potential life insurance savings.

3. What's the best way to keep track of my savings after quitting smoking?

Use a savings app or a dedicated account to track your savings.

4.What is the most significant benefit of quitting smoking?

The most significant benefit is improved health and the potential for a longer, happier life.